Section 179 Tax Benefits

Tax Benefits for Small Businesses

Get the equipment you need to support your business while protecting your bottom line at the same time. With Section 179 and Mountain Chevrolet, you can do that and more. Our team is dedicated to helping you achieve a more seamless and beneficial shopping experience. It's one of the reasons why so many small business owners choose our dealership as their destination when they want to grow their business inventory.

Section 179 | How it Works

Section 179 allows businesses to deduct the cost of qualifying equipment purchases immediately. In the past, businesses could achieve this feat, but only by writing off the cost of depreciation year after year. Section 179 changed it to make it easier on businesses.

What's Included

To qualify for Section 179 tax deductions in 2025, the vehicle must be purchased or leased in 2025 and employed for business purposes at least 50% of the time. Not all vehicles will qualify, and there are limits. For example, in 2025, the limit for SUVs and trucks is $31,300.

These Chevy models qualify under Section 179.

- Chevy Silverado 1500

- Chevy Silverado HD

- Chevy Colorado

- Chevy Blazer EV

- Chevy Equinox EV

- Chevy Suburban

- Chevy Express Vans

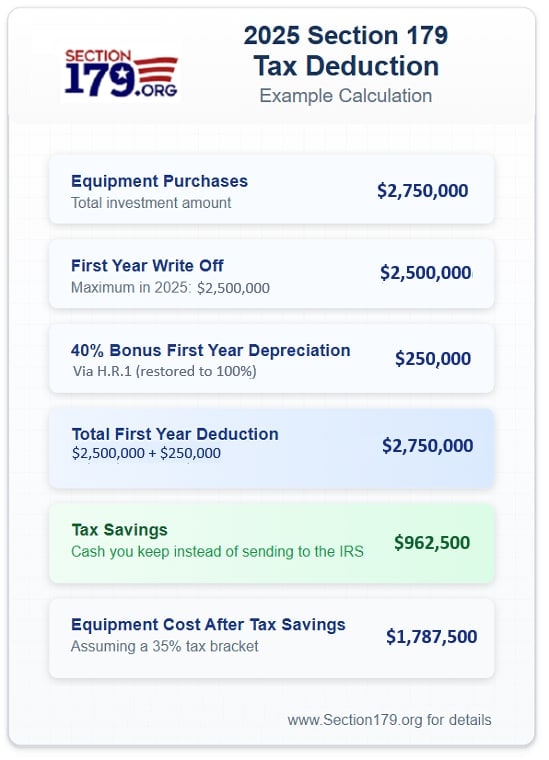

2025 Section 179 Limits

Tax codes change. In 2025, you can expect these limits to be in place for Section 179.

- Maximum deduction for SUVs & Trucks: $31,300

- Deduction limit: $1,250,000

- Spending cap: $3,130,000

- Phase-Out threshold: $4,380,000

- Bonus depreciation: 40%

Section 179 vs. Bonus Depreciation

Section 179 and Bonus Depreciation offer tax benefits but are treated differently. Some of the differences include deduction limits. Section 179 has deduction limits, but Bonus Depreciation does not. Section 179 allows unused deductions to be carried forward, whereas Bonus Depreciation does not. There is no phase-out based on income for Bonus Depreciation, but there is for Section 179. As part of a tax strategy, using Section 179 and Bonus Depreciation can help fill in gaps that your tax advisor can assist you with.

Contact Mountain Chevrolet for More Information

Our team looks forward to helping your business grow. Visit us online or call our dealership today.

How Can We Help?

* Indicates a required field

-

MOUNTAIN CHEVROLET LLC

51359 Highway 6

Glenwood Springs, CO 81601

- Sales: (877) 900-4566